Clarification on TDS (Income-Tax) by PCDA - RANK PAY While disbursing the payments of Rank Pay Arrears I-Tax(TDS) @ 10% was deducted (where correct PAN No. is available) and Income Tax (IT) @ 20% has been deducted (where PAN No. is not available). The amount has been credited to IT head. The above deductions will be reflected in the 26AS return filed by this … [Read more...] about Clarification on TDS (Income-Tax) by PCDA – RANK PAY

CENTRAL GOVERNMENT HOLIDAYS IN 2025

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 50% DA Order for Central Government Employees wef 1st Jan 2024 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Search Results for: TDS

HIGHLIGHTS OF THE UNION BUDGET 2023-2024

Ministry of Finance HIGHLIGHTS OF THE UNION BUDGET 2023-24 Posted On: 01 FEB 2023 The Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharaman presented the Union Budget 2023-24 in Parliament today. The highlights of the Budget are as follows: PART A · Centre to recruit 38,800 teachers and support staff for the 740 Eklavya Model Residential … [Read more...] about HIGHLIGHTS OF THE UNION BUDGET 2023-2024

Budget 2023 Major relief in the personal income tax

Budget 2023 - New tax regime Smt Nirmala Sitharaman provides major relief in the personal income tax. The indirect tax proposals contained in the budget aim to promote exports enhance domestic value addition, encourage green energy and mobility. Personal Income Tax There are five major announcements relating to the personal income tax. The rebate limit in the new tax … [Read more...] about Budget 2023 Major relief in the personal income tax

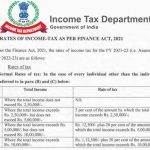

DEDUCTION OF TAX AT SOURCE INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2022-2023

INCOME-TAX DEDUCTION FROM SALARIES GOVERNMENT OF INDIAMINISTRY OF FINANCE(DEPARTMENT OF REVENUE)CENTRAL BOARD OF DIRECT TAXES DEDUCTION OF TAX AT SOURCE- INCOME-TAXDEDUCTION FROM SALARIESUNDER SECTION 192 OF THE INCOME-TAX ACT, 1961 DURING THE FINANCIAL YEAR 2022-23 CIRCULAR NO. 24/2022 NEW DELHI, the 07th December, 2022 Table of Contents 1. Definition of … [Read more...] about DEDUCTION OF TAX AT SOURCE INCOME-TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2022-2023

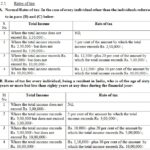

32% Dearness Relief to Central freedom fighter pensioners w.e.f. 01.01.2022

DR to Central Freedom Jan 2022 - Grant of Dearness Relief 32% to Central Freedom Fighter Pensioners w.e.f. 01.01.2022 F.No.45/08/ 2017-FF(P)Government of India/ Bharat SarkarMinistry of Home Affairs/ Grih MantralayaFreedom Fighters & Rehabilitation Division 2nd Floor, NDCC-II Building,Jai Singh Road, New Delhi – 110 001,Dated, the 25th April 2022 To The Pr. … [Read more...] about 32% Dearness Relief to Central freedom fighter pensioners w.e.f. 01.01.2022

32% Dearness Relief to be paid to the freedom fighter pensioners w.e.f 01.01.2022

Dearness Relief to Central Freedom Fighter Pensioners @ 32% w.e.f. 01.01.2022 admissible to the Central Freedom Fighter/ spouse/ daughter pensioners. F.No.45/08/2017 -FF(P)Government of India/ Bharat SarkarMinistry of Home Affairs/ Grih MantralayaFreedom Fighters & Rehabilitation Division 2nd Floor, NDCC-II Building,Jai Singh Road, New Delhi -110 001,Dated, the 8th … [Read more...] about 32% Dearness Relief to be paid to the freedom fighter pensioners w.e.f 01.01.2022

INCOME-TAX DEDUCTION FROM SALARIES UNDER SECTION 192 FINANCIAL YEAR 2021-2022 PDF

GOVERNMENT OF INDIA MINISTRY OF FINANCE(DEPARTMENT OF REVENUE)CENTRAL BOARD OF DIRECT TAXES DEDUCTION OF TAX AT SOURCEINCOME-TAX DEDUCTION FROM SALARIES UNDER SECTION 192 OF THE INCOME-TAX ACT, 1961DURING THE FINANCIAL YEAR 2021-22 CIRCULAR NO 04/2022 NEW DELHI, the 15th March, 2022 Table of Contents 1. Definition of “salary”, “perquisite” and ‘profit in lieu … [Read more...] about INCOME-TAX DEDUCTION FROM SALARIES UNDER SECTION 192 FINANCIAL YEAR 2021-2022 PDF

UNION BUDGET 2022-2023 HIGHLIGHTS – PIB

Union Budget 2022-2023: Tax deduction limit increased from 10 % to 14% on employer’s contribution to the NPS account of State Government employees - Brings them at par with central government employees - Parity in National Pension Scheme Ministry of Finance HIGHLIGHTS OF THE UNION BUDGET 2022-23 01 FEB 2022 The Union Budget seeks to complement macro-economic level … [Read more...] about UNION BUDGET 2022-2023 HIGHLIGHTS – PIB

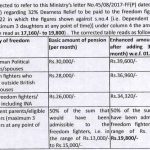

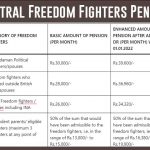

Revised Rate of Dearness Relief to Central Freedom Fighter Pensioners from July 2021

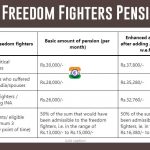

Dearness Relief 29% to Central Freedom Fighter Pensioners from July 2021 Ex-Andaman political prisoners/spouses are a category of freedom fighters.Pension Basic Amount (Per Month): Rs.30,000With effect from July 1, 2021, the enhanced amount of pension after adding 29 percent Dearness Releif (per month) is Rs.38,700. GOVERNMENT OF INDIAMINISTRY OF FINANCEDEPARTMENT OF … [Read more...] about Revised Rate of Dearness Relief to Central Freedom Fighter Pensioners from July 2021

Grant of Dearness Relief to Central freedom fighter pensioners w.e.f. 01.07.2021

Central Freedom Fighters Pension 2021 11% of Dearness relief increased to Central Government Freedom Fighters with effect from 1st July 2021. F.No.45/08/2017-FF(P)Government of India/Bharat SarkarMinistry of Home Affairs/Grih MantralayaFreedom Fighters & Rehabilitation Division 2nd Floor, NDCC-II Building,Jai Singh Road, New Delhi - 110 001,Dated, the 28th July, … [Read more...] about Grant of Dearness Relief to Central freedom fighter pensioners w.e.f. 01.07.2021

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF