GPF final payment

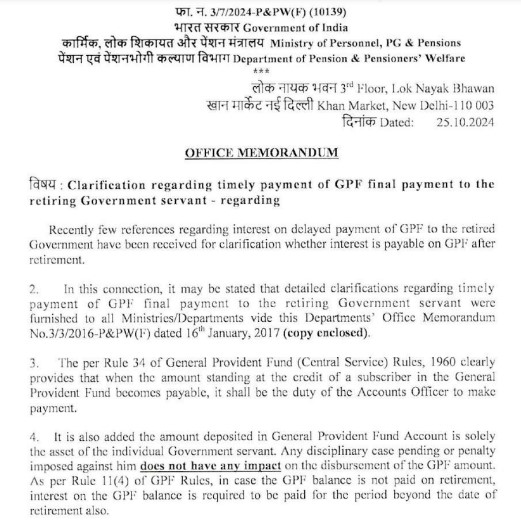

फा.न. 3/7/2024-P&PW(F) (10139)

Government of India

Ministry of Personnel, PG & Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhawan

Khan Market, New Delhi -110 003

Dated: 25.10.2024

OFFICE MEMORANDUM

Subject: Clarification regarding timely payment of GPF final payment to the retiring Government servant – regarding

Recently few references regarding interest on delayed payment of GPF to the retired Government have been received for clarification whether interest is payable on GPF after retirement.

2. In this connection, it may be stated that detailed clarifications regarding timely payment of GPF final payment to the retiring Government servant were furnished to all Ministries/Departments vide this Departments’ Office Memorandum No.3/3/2016-P&PW(I) dated 16th January, 2017 (copy enclosed).

3. The per Rule 34 of General Provident Fund (Central Service) Rules, 1960 clearly provides that when the amount standing at the credit of a subscriber in the General Provident Fund becomes payable, it shall be the duty of the Accounts Officer to make payment.

4. It is also added the amount deposited in General Provident Fund Account is solely the asset of the individual Government servant. Any disciplinary case pending or penalty imposed against him does not have any impact on the disbursement of the GPF amount. As per Rule 11(4) of GPF Rules, in case the GPF balance is not paid on retirement, interest on the GPF balance is required to be paid for the period beyond the date of retirement also.

5. This issues with the approval of competent authority.

Encl- As above.

(Dilip Kumar Sahu)

Under Secretary to the Govt. of India

Leave a Reply