Deduction of tax for the first quarter of the financial year 2023-24, may be furnished on or before 30th September, 2023. Circular No. 9/2023 F.No.370149/ 109/ 2023 -TPLGovernment of IndiaMinistry of FinanceDepartment of RevenueCentral Board of Direct Tax North Block, New Delhi 28th June, 2023 Sub: Order under section 119 of the Income-tax Act, 1961 for extension … [Read more...] about Extension of time limits for submission of certain TDS/TCS Statements – CBDT

CENTRAL GOVERNMENT HOLIDAYS IN 2025

CENTRAL GOVERNMENT HOLIDAY LIST 2024

| 50% DA Order for Central Government Employees wef 1st Jan 2024 PDF |

| CGHS Updated Rate Card PDF Download |

| Latest List of KV Schools in India |

| 7th Pay Commission Latest News 2024 |

| MACP for the Central Government Employees |

Search Results for: TDS

Deduction or Non-deduction of TDS in SCSS accounts in post office

Senior Citizen Savings Scheme Even after submitting form 15G/15H for the current Financial Year, TDS has been deducted from SCSS account holders' interest payments. SB Order No. 37/2021 F. No. FS-13/7/2020-FSGovernment of IndiaMinistry of CommunicationsDepartment of Posts(Financial Services Division) Dak Bhawan New Delhi-110001Dated: 22.11.2021. To, All Head … [Read more...] about Deduction or Non-deduction of TDS in SCSS accounts in post office

Central Government relaxes TDS restrictions under section 194A of the Income tax Act 1961 – CBDT

Section 194 of income tax act 1961 - Central Government relaxes TDS restrictions under section 194A of the Income-tax Act, 1961. MINISTRY OF FINANCE(Department of Revenue)(CENTRAL BOARD OF DIRECT TAXES) NOTIFICATION New Delhi, the 17th September, 2021 INCOME TAX S.O. 3815(E). - In exercise of the powers conferred by sub-section (1F) of section 197A of the … [Read more...] about Central Government relaxes TDS restrictions under section 194A of the Income tax Act 1961 – CBDT

CBDT clarifies the TDS provisions on Mutual Fund dividend

Ministry of FinanceCBDT issues clarification on the applicability of TDS provisions on Mutual Fund dividend 04 FEB 2020 The Finance Bill, 2020 proposed to remove Dividend Distribution Tax (DDT) at the level of Company/ Mutual Fund and proposed to tax the same in the hands of share/ unit holder. It was also proposed to levy TDS at the rate of 10% on the dividend/ income … [Read more...] about CBDT clarifies the TDS provisions on Mutual Fund dividend

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder - DoP SB Order No. 02/2020 F.No 109-27/2019-SBGovt. of India Ministry of CommunicationDepartment of Posts (F.S. Division) Dak Bhawan, New Delhi-110001 Dated: 09.01.2020 To, All Head of Circles / Regions Addl. Director General, APS, New Delhi Subject :- … [Read more...] about Deduction of TDS in respect of Cash Withdrawal above One Crore by a National Savings Schemes account holder – DoP

Income Tax department revises the Form 16 TDS certificate format issued by employers

Income Tax department revises the (Form 16) TDS certificate format issued by employers The Income Tax department has revised Form 16 by adding various details, including income from house property and remuneration received from other employers, thereby making it more comprehensive to help check tax avoidance. It will also include segregated information regarding … [Read more...] about Income Tax department revises the Form 16 TDS certificate format issued by employers

TDS deduction under section 194A of the Income-tax Act, 1961 in case of Senior Citizens

TDS deduction under section 194A of the Income-tax Act, 1961 in case of Senior Citizens F. No. Pr. DGIT(S)/CPC(TDS)/Notification/2018-19 Government of India Ministry of Finance Central Board of Direct Taxes Directorate of Income-tax (Systems) New Delhi Notification No. 06 /2018 New Delhi, 06th December, 2018 Subject: - TDS deduction under section 194A of the … [Read more...] about TDS deduction under section 194A of the Income-tax Act, 1961 in case of Senior Citizens

Process to accept/reject GST TDS-Credit

Process to accept/reject GST TDS-Credit - RBA No 120 /2018 GOVERNMENT O1 INDIA MINISTRY OF RAILWAYS RAILWAY BOARD RBA No. 120 /2018 GST Circular No. 45 /2018 No. 2018/AC-II/1/46 15th November, 2018 Principal Financial Advisers, All Zonal Railways and Production Units Sub:- Process to accept/reject GST TDS-Credit. GSTN portal has come up with a functionality to … [Read more...] about Process to accept/reject GST TDS-Credit

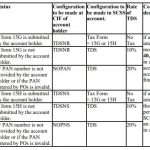

Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme

Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme F.No 79-01/2016-SB Government of India Ministry of Communications Department of Posts DakBhawan, Sansad Marg, New Delhi-110001 Date: 29.06.2018 To All Heads of Circles/Regions Addl. Director General, APS, New Delhi. Subject - Deduction of TDS in respect of Senior … [Read more...] about Deduction of TDS in respect of Senior Citizens who have Invested In Sr.Citizen Savings Scheme

TDS on approved Provident and Superannuation Funds as per Income-Tax Act

TDS on approved Provident and Superannuation Funds as per Income-Tax Act TDS on payment of accumulated balance under recognised provident fund and contribution from approved superannuation fund Ministry of Finance has issued a circular about details of TDS on approved Provident and Superannuation Funds as per Income-Tax Act TDS ON PAYMENT OF ACCUMULATED BALANCE UNDER … [Read more...] about TDS on approved Provident and Superannuation Funds as per Income-Tax Act

Latest DoPT Orders 2024

CENTRAL GOVT HOLIDAY LIST 2024

Indian Railway Holiday List 2023 PDF | Postal Holidays List 2023 India Post | Bank Holidays List 2023 India | LIC Office Holiday List 2023 PDF Download | EPFO Holiday List 2023 PDF Download | ESIC Holiday List 2023 PDF Download | CGHS Holiday Calendar List 2023 | Post Office Holidays 2023 | Railway Holidays CG Office Holidays 2023 | TN Govt Holidays 2023 | KVS Holiday List 2023-2024 PDF