Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2024: MHA order dated 17.12.2024

Co No.45/08/ 2017-FF(P)

Government of India/ Bharat Sarkar

Ministry of Home Affairs/ Grih Mantralaya

Freedom Fighters & Rehabilitation Division

2nd Floor, NDCC-II Building,

Jai Singh Road, New Delhi – 110 001,

Dated, the 17th December , 2024.

To

The Pr. Chief Controller of Accounts(Home),

Ministry of Home Affairs, :

MDCNS, New Delhi- 110 001

Subject: Grant of Dearness Relief to Central Freedom Fighter Pensioners w.e.f. 01.07.2024 – regarding

Sir,

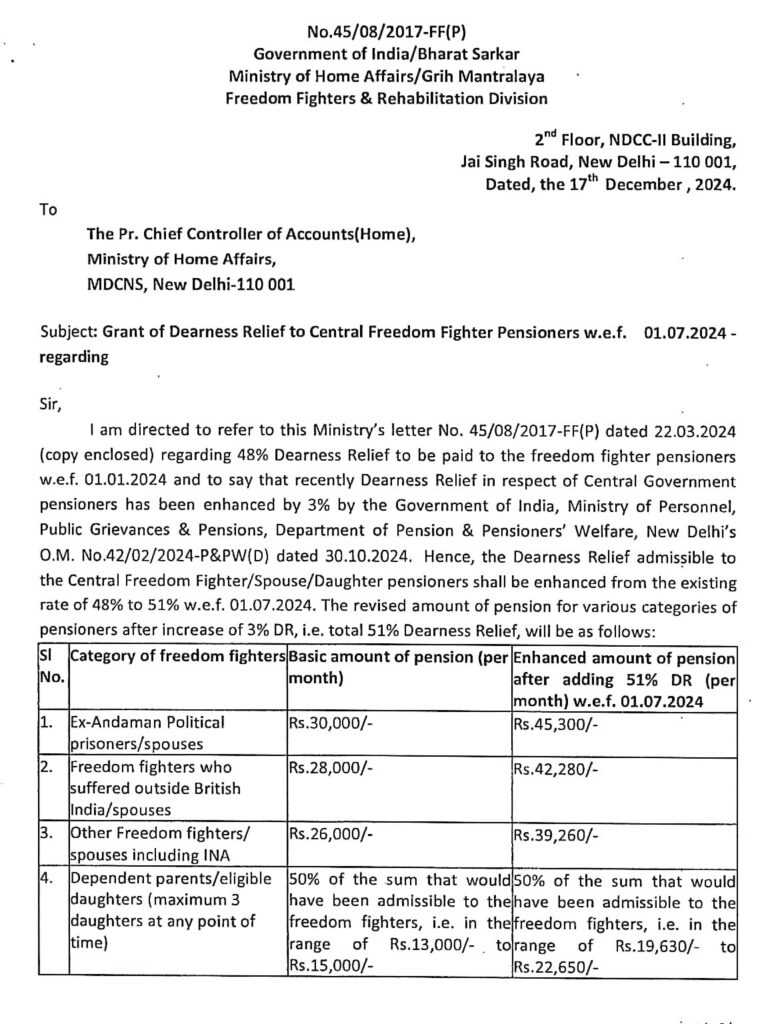

I am directed to refer to this Ministry’s letter No. 45/08/2017-FF(P) dated 22.03.2024 (copy enclosed) regarding 48% Dearness Relief to be paid to the freedom fighter pensioners w.e.f. 01.01.2024 and to say that recently Dearness Relief in respect of Central Government pensioners has been enhanced by 3% by the Government of India, Ministry of Personnel, Public Grievances & Pensions, Department of Pension & Pensioners’ Welfare, New Delhi’s O.M. No.42/02/ 2024-P&PW(D) dated 30.10.2024. Hence, the Dearness Relief admissible to the Central Freedom Fighter/ Spouse/ Daughter pensioners shall be enhanced from the existing rate of 48% to 51% w.e.f. 01.07.2024. The revised amount of pension for various categories of pensioners after increase of 3% DR, i.e. total 51% Dearness Relief, will be as follows:

| Sl No. | Category of freedom fighters | Basic amount of pension (per month) | Enhanced amount of pension after adding 51% DR (per month) w.e.f. 01.07.2024. |

| 1. | Ex-Andaman Political prisoners/ spouses | Rs.30,000/- | Rs.45,300/- |

| 2. | Freedom fighters who suffered outside British India/ spouses | Rs.28,000/- | Rs.42,280/- |

| 3. | Other Freedom fighters/ spouses including INA | Rs.26,000/- | Rs.39,260/- |

| 4. | Dependent parents/ eligible daughters (maximum 3 daughters it any point of time) | 50% of the sum that would have been admissible to the freedom fighters, i.e. in the range off Rs.13,000/- to Rs.15,000/- | 50% of the sum that would have been admissible to the freedom fighters, i.e. in the range of Rs.19,630/- to Rs.22,650/- |

2. Further, it is also clarified that as per Policy Guidelines dated 06.08.2014, TDS is not applicable in respect of Central Samman Pension.

3. This issues with the approval of Competent Authority.

Yours faithfully,

(R.C. Meena)

Director

Leave a Reply